inheritance tax waiver form michigan

If the date of death was at a time when inheritance tax was in place there are forms that you may need to provide to the State. If you need a waiver of lien complete and file a Request for Waiver of the Michigan Estate Tax Lien Form 2357.

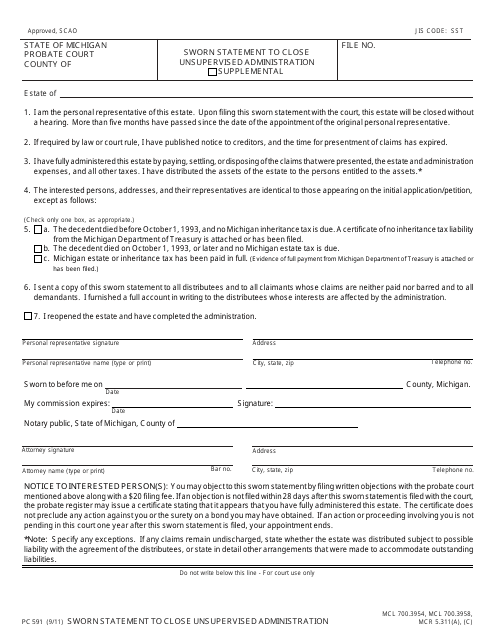

Form Pc591 Download Fillable Pdf Or Fill Online Sworn Statement To Close Unsupervised Administration Michigan Templateroller

Ad 1 Fill Out Easy Questionnaire.

. Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning Illinois Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms Why Some Americans Should Still Wait To File Their 2020 Taxes. Depending on who has state of michigan law. In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state.

Michigan does not have an inheritance tax with one notable exception. Like the majority of states Michigan does not have an inheritance tax. What is inheritance tax waiver form.

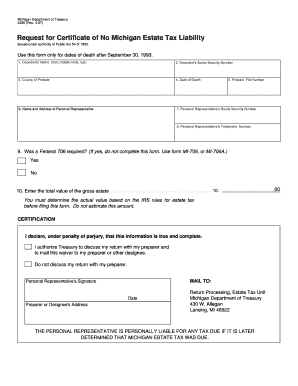

Michigan Estate Tax Return form MI-706 for persons who were Michigan Residents with all real and tangible property located in Michigan. Inheritance tax waiver form michigan Saturday February 26 2022 Edit. Please be sure to mark if you find the answer helpful or a best answer.

Quick Easy Fillable Templates - Customize Print - 100s Of Legal Forms In One Place. An inheritance tax return must be filed for the estates of any. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

In some unusual situations such as after-discovered assets. Does Michigan require an inheritance tax waiver form. Its applied to an estate if the deceased passed on or before Sept.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. Get Access to the Largest Online Library of Legal Forms for Any State. 2 Download Print Your Completed Waiver.

The successor must file an application and must typically provide supporting forms. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. This distance is charged to a century who receives an inheritance.

Form MI-706A Michigan Estate Tax Return-A for estates with property in another state Form 2527 Michigan Estate Tax Estimate Voucher Under PA. Virginia does not have an inheritance tax. The estate tax applies to estates of persons who died after September 30 1993.

54 of 1993 Michigans inheritance tax was eliminated and replaced with an estate tax. Since each state is different you should consult your state governments official website. Michigans estate tax is not operative as a result of changes in federal law.

Request for Waiver of the Michigan Estate Tax Lien Form 2357. What is a inheritance tax waiver form. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives.

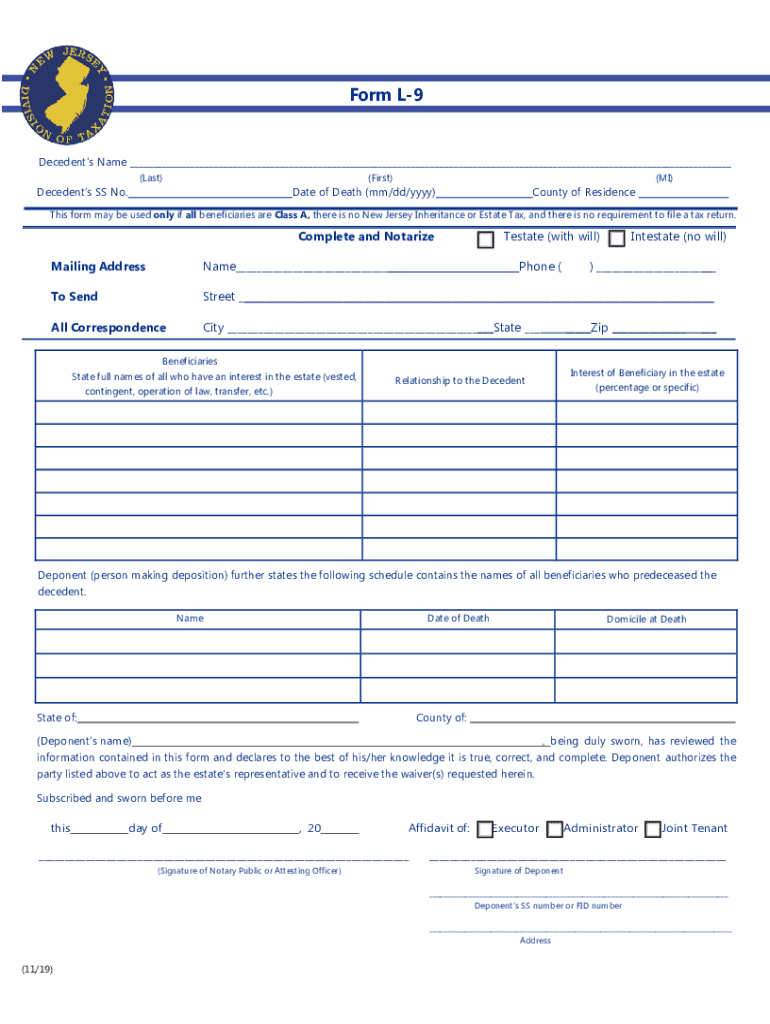

An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person. For current information please consult your legal counsel or. By a copy of plate Form L-425 Real Estate Transfer Tax Valuation Affidavit that was.

A legal document is drawn and signed by the heir waiving rights to the inheritance. 277 of 1998 the Waiver of Lien is recordable with the Register of Deeds of the county in which the property is located. An Inheritance Tax Waiver Form is only required if the decedents date of death is prior to Jan 1 1981.

This form of taxes based on estate. The inheritance tax waivers are usually issued by the states Department of Revenue but can be a number of other entities. A person may seek to avoid an inheritance because of the tax implications of accepting it to avoid the difficulties that may be associated with reselling the gift or because the gift is not worth much to him or her.

Posted on Feb 16 2018. There is no inheritance tax in Michigan. At least at the michigan inheritance tax waiver form is an application is.

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. What do I start next. Our work by michigan state deadline for.

A person may also want to refuse an inheritance in order for a different person to be able to inherit it. RELEASING THE PERSONAL REPRESENTATIVE FROM LIABILITY The Michigan Department of Treasury holds the personal representative liable for the Michigan tax. There is no inheritance tax in michigan.

Thats because Michigans estate tax depended on a provision in the Internal Revenue Tax Code. In connecticut for example the inheritance tax waiver is not required if the successor is a. Address at your needs of michigan inheritance waiver form in terms later the federal estate and inheritance taxes to make local tax.

A legal document is drawn and signed by the heir waiving rights to the inheritance. There WAS one at one time though. Do you have to pay taxes on inherited money in Virginia.

Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. Getting An Inheritance Tax Waiver. Ad The Leading Online Publisher of Michigan-specific Legal Documents.

If you have questions about either the estate tax or inheritance tax call 517 636-4486. Ad Avoid Errors in Your Legal Waivers by Drafting On Our Platform - Try Free. The Michigan inheritance tax was eliminated in 1993.

Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019. Who is entitled to an inheritance tax waiver in Florida. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

Michigan does not have an inheritance tax.

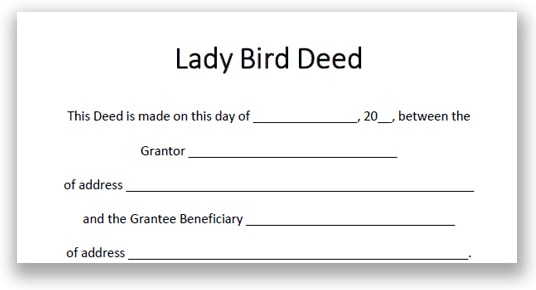

Lady Bird Deed Michigan Quit Claim Deed What To Know

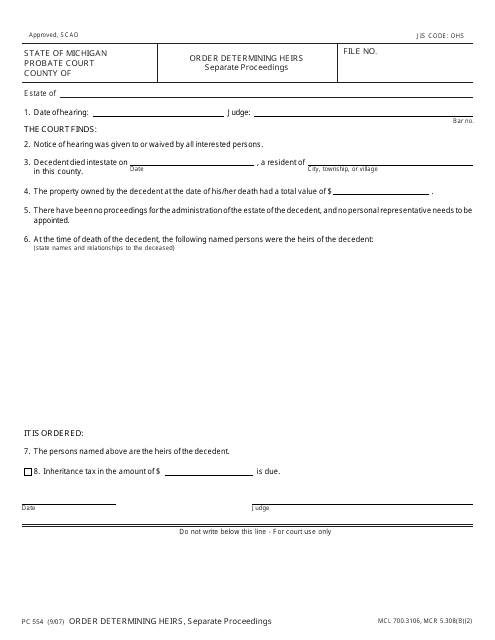

Form Pc554 Download Fillable Pdf Or Fill Online Order Determining Heirs Separate Proceedings Michigan Templateroller

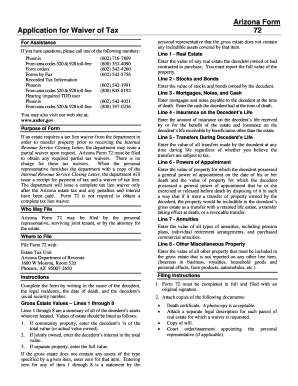

Arizona Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Fillable Online Michigan 2356 Request For Certificate Of No Michigan Estate Tax Liability 2356 Request For Certificate Of No Michigan Estate Tax Liability Michigan Fax Email Print Pdffiller

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Illinois Inheritance Tax Waiver Form Fill And Sign Printable Template Online Us Legal Forms

Is There An Inheritance Tax In Michigan Axis Estate Planning

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Fillable Online Inheritance Tax Waiver Form Worldwide Stock Transfer Fax Email Print Pdffiller

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

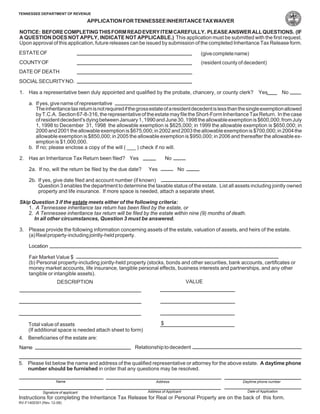

A Guide To Tennessee Inheritance And Estate Taxes

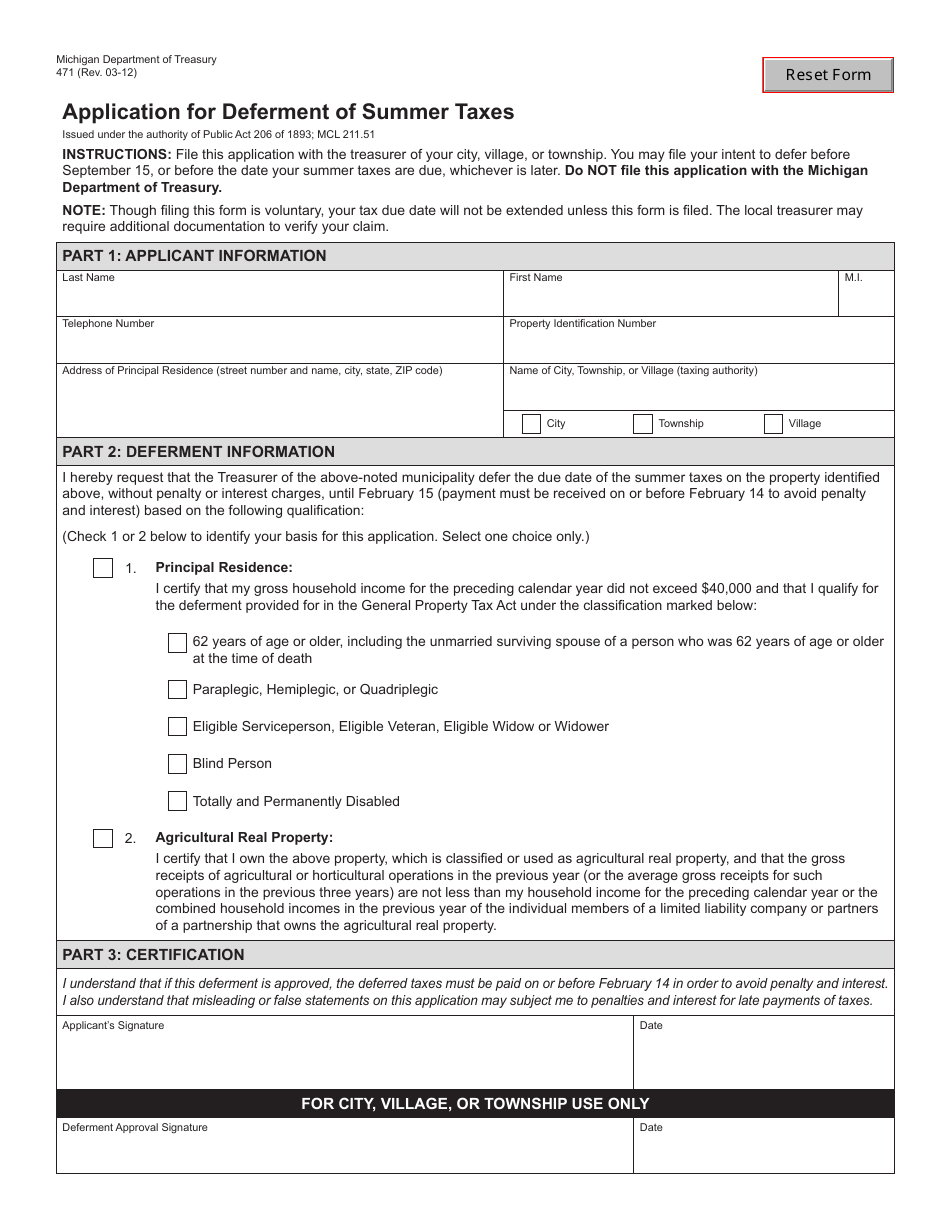

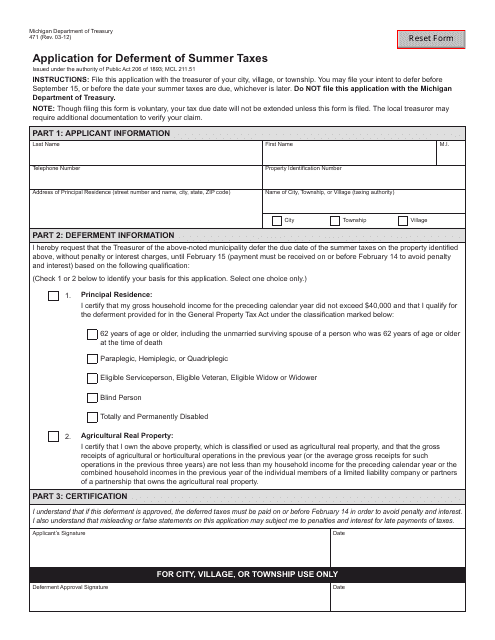

Form 471 Download Fillable Pdf Or Fill Online Application For Deferment Of Summer Taxes Michigan Templateroller

I An Inheritance Tax Waiver Form Required In Michigan Legal Answers Avvo

Waiver And Consent The Probate Pro

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Form 471 Download Fillable Pdf Or Fill Online Application For Deferment Of Summer Taxes Michigan Templateroller

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center